Australia needs to support older home buyers

Political parties in Australia should develop policies that support older Australians who don’t own property to enter the housing market.

I’m commenting after the Australian Labor Party released its housing policy for the 2025 federal election, at least the version of it that’s been reported on the ABC and in the other media.

Labor is planning to go guarantor for first-home buyers, allowing them to purchase a home with a 5% deposit, avoiding lenders mortgage insurance, and currently most banks are requiring a 20% deposit.

They’re also going to put $10 billion towards building up to 100,000 homes exclusively for first-home buyers.

Now, looking at these two policies, I support the first one. I think that’s a really useful initiative. I think 20% is too much in today’s lending market and property is a very safe investment, or has been in Australia at least for the last 30 or 40 years.

By the government going guarantor, it’s going to take a lot of pressure off parents (The “bank of mum and dad”) who have otherwise been corralled into doing that in many cases.

The second part, though, I don’t support. I think when you put money towards things like stamp duty concessions or subsidies for first home buyers to enter the market, it’s actually inflationary.

I think there’s been no doubt about that and most economists agree that these types of schemes have contributed to the escalating cost of housing in Australia, so it can actually be worsening the problem rather than improving it.

The other point that I’d make about it is that why, oh why, is the focus constantly on first home buyers? There are lots and lots of older Australians who are struggling to get into the housing market or get back into the housing market.

I read a story in The Guardian towards the end of last year about this particular issue and there was a researcher at the University of Queensland (Joelle Moore) who’s doing a thesis on it. I reached out to her and she interviewed me for part of her research.

Some of the points we talked about were that many people in their 50s and 60s have been through a divorce, they might have lost their property or had it reduced in value, their equity in it, and it’s very hard for them to get back into the housing market.

And for women in particular, the issues are even worse because in most cases they have less superannuation than men their own age because they haven’t been in the workforce for as long or they have taken a period out of the workforce to have and raise children.

So I don’t understand why the government or the Labor Party in this case is focused on first home buyers at the exclusion of older home buyers who are in just as much difficulty as first home buyers, in fact more so because it’s harder for them to get finance from banks.

In my own particular case, I’m looking at accessing my superannuation after I’m 60 to potentially buy land or buy a property and that’s going to be the only way that I can see that I’m going to get back into the housing market.

So I’m saying to all politicians and all political parties, yes support first home buyers through schemes such as what’s been proposed for the government to be guarantor for them, but don’t give them subsidies, don’t give them stamp duty concessions, look at sector-wide, demographic-wide policies that are going to help all Australians equally. Make sure your policies are equitable.

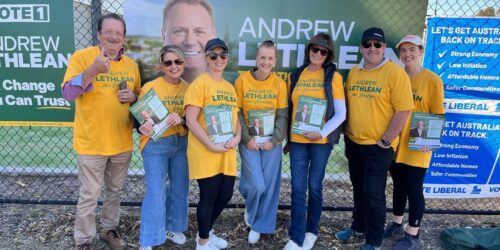

UPDATE: I’m aware that after I recorded this, the Liberal Party also released a policy to assist first home-buyers, and the comments in relation to older home buyers apply equally to them.

- My audio blogs are available on Voice Notes Pages and most podcast apps.

- Trump tariffs and Australia